Milestone: VC legend backs HK biotech startup

Wednesday, March 11, 2015 at 8:12PM

Wednesday, March 11, 2015 at 8:12PM

Hong Kong has won acclaim over the years for its kung-fu movies, excellent dining, spectacular skyline and free economy.

But never for its technology.

So today may eventually be regarded as a modest milestone in its path to becoming a technology hub. It's probably fair to say few Hong Kong citizens are aware that that is a path they are on. In fact, governments over the past 15 years have built science parks and incubators and tipped in growing amounts of R&D cash.

Today's news is that a local startup, Vitargent, has taken on Taiwan-American VC firm W.I. Harper as an investor for an undisclosed amount.

That may sound modest in the extreme, but Harper chairman Peter Liu has enormous cred in the tech investment community. In a career that goes back to 1983 in Taiwan and 1992 in China, his successes include Singapore's Creative Technologies, the inventor of the PC soundcard, and video software firm Divx. Currently, he is an early stage investor in apps search firm Quixey, which has attracted investment from Alibaba and Softbank that values it at $600m.

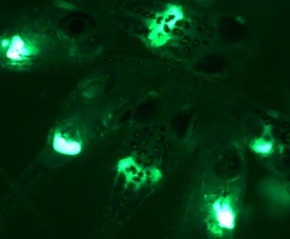

Vitargent's back story isn't as long but it's impressive. An incubatee at the Hong Kong Science Park, it uses fish embryo to test for toxins way more effectively than anyone else. Traditional tests can identify five to ten toxins; it can test for 1,000 (that's transgenic medaka, or Japanese rice fish, glowing fluorescent green, above).

The company has sold its product to international cosmetics and food companies, and according to Liu another major deal is in the pipeline. It has won a brace of awards: The Clinton Global Initiative, the Lee Kwan Yew Global Business Competition, the HSBC Young Entrepreneur Awards. the Hong Kong Awards for Industries.

Vitargent founder Eric Chen says since word leaked of the Harper investment he's had investors beating a path to his door. Although that sounds like startup hyperbole, VCs are herd animals and that's exactly how they behave. The biggest impact from this could be to put Hong Kong finally on the tech investment map.

Robert |

Robert |  Post a Comment |

Post a Comment |  Hong Kong,

Hong Kong,  Vitargent in

Vitargent in  Innovation

Innovation